The SMART methodology serves as a beacon of clarity and direction in the often murky waters of goal-setting. It’s like having a trusted roadmap that guides you from where you are to where you want to be, step by step. Imagine sitting down with a clear vision of what you want to achieve, breaking it down into specific, measurable, achievable, relevant, and time-bound milestones. That’s the essence of SMART. How to apply the SMART budgeting method? By following these principles, you can create a structured and effective budget that ensures your financial goals are clear and attainable.

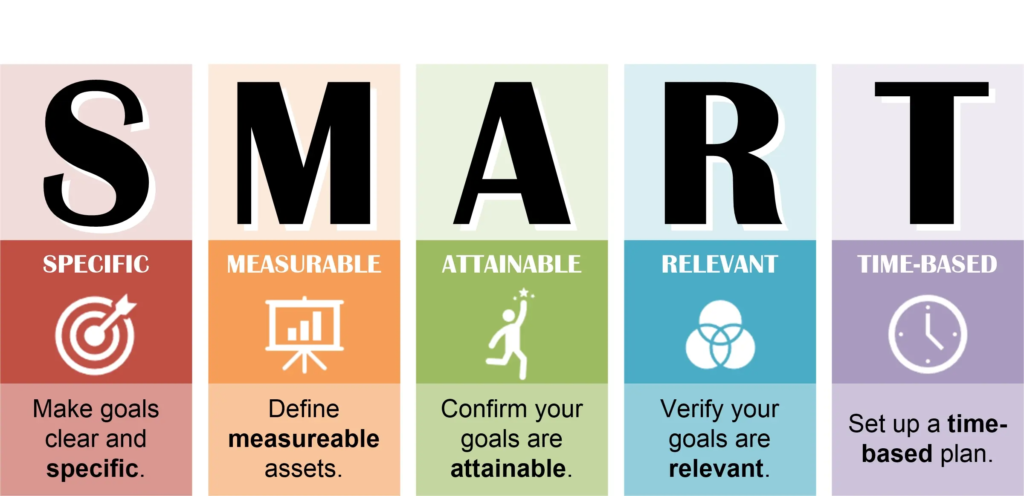

Each letter in SMART represents a crucial aspect of goal-setting. “S” reminds us to be Specific, ensuring that our objectives are crystal clear and leave no room for ambiguity. “M” urges us to make our goals Measurable, so we can track our progress and know when we’ve succeeded. “A” encourages us to be realistic and set goals that are Achievable, given our resources and circumstances. “R” prompts us to make our goals Relevant, aligning them with our broader aspirations and priorities. Finally, “T” emphasizes the importance of setting deadlines, ensuring that our goals are Time-bound and motivating us to take action.

In essence, the SMART methodology empowers us to turn dreams into reality, providing a structured approach to goal-setting that increases our chances of success. It’s about setting ourselves up for victory by defining our goals with precision, planning our journey thoughtfully, and staying focused on the path ahead. With SMART, we can navigate the complexities of goal-setting with confidence, knowing that each step we take brings us closer to our dreams.

Implementing the SMART method on your monthly budget begins with setting clear and specific financial objectives. Start by identifying what you want to achieve with your budget. Is it to save for a vacation, pay off debt, or build an emergency fund? Be specific about the amount you aim to save or allocate towards each goal. For example, you might set a goal to save $500 for a vacation within the next six months. This specificity provides a clear target to work towards and helps you stay focused on your financial priorities.

Next, ensure your budget goals are measurable and achievable. Break down your larger financial objectives into smaller, manageable milestones. Determine how much you need to save or allocate each month to reach your goals on time. This could involve calculating how much money you need to set aside each month to reach your vacation savings goal, for instance. Additionally, ensure that your goals are realistic and align with your current financial situation. Consider factors such as your income, expenses, and any existing financial commitments. By setting achievable and measurable goals, you can track your progress, stay motivated, and make adjustments to your budget as needed to stay on track towards financial success.

Let’s apply the SMART method to a monthly budget for a cashier working in a supermarket with a net income of 1800 euros.

Specific: The cashier’s specific goal might be to save 300 euros each month to build an emergency fund.

Measurable: Saving 300 euros each month is a measurable goal. The cashier can track their progress by monitoring their savings account balance or keeping a record of their contributions.

Achievable: Given the cashier’s net income of 1800 euros, saving 300 euros per month is achievable with careful budgeting and prioritization of expenses.

Relevant: Building an emergency fund is relevant to the cashier’s financial well-being and provides a safety net for unexpected expenses, aligning with their long-term financial goals.

Time-bound: The cashier sets a timeframe of six months to reach their savings goal of 1800 euros, providing a clear deadline and sense of urgency.

Implementation:

-

- Needs (50%): Allocate 900 euros towards essential expenses such as rent, utilities, groceries, transportation, and minimum debt payments.

-

- Savings (20%): Dedicate 360 euros towards building the emergency fund, prioritizing this goal to ensure consistent progress.

-

- Wants (30%): Use the remaining 540 euros for discretionary spending on dining out, entertainment, personal care, and other non-essential expenses.

By applying the SMART method to their monthly budget, the cashier can effectively prioritize their savings goal, track their progress, and make informed financial decisions to achieve their objectives. This approach empowers them to take control of their finances and work towards greater financial stability and security.